Banking

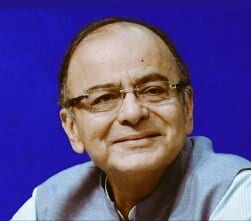

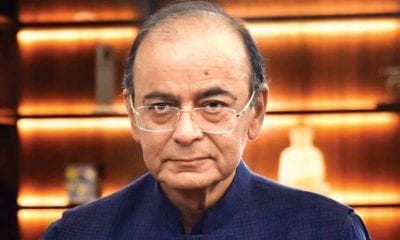

Centre does not require RBI funds for 6 months: Arun Jaitley

In an interview to a TV channel, union finance minister Arun Jaitley had said that the Modi Government does not require funds from the Reserve Bank of India (RBI) for the next six months.

“I don’t need money in the next six months,” Finance Minister Arun Jaitley said.

Critics accuse the government of trying to undermine the central bank’s authority, but Jaitley said his government respected the institution’s independence.

“We respect the autonomy (of the RBI) but, at the same time, if some sectors are starved of liquidity or credit, we will flag those issues. We do so with the RBI.”

The Congress, India’s main opposition party, has accused Prime Minister Narendra Modi’s government of eyeing the cash reserves held by the RBI.

“Government is determined to ‘capture’ RBI in order to gain control over the reserves,” P. Chidambaram, a former finance minister and a top Congress leader tweeted last week.

New Delhi has been pushing for access to RBI’s surplus reserves prompting the central bank’s board to form an expert panel to look into whether its cash pool is adequate.

The board whose members include government nominees, in a meeting last week, advised the RBI to aid small businesses and give bankers more time to step up capital norms to encourage lending and stimulate the economy ahead of next year’s election.

Earlier sources told DNA Money that the committee for examining the Economic Capital Framework (ECF) to determine the Reserve Bank of India’s (RBI) surplus transfers to the central government will be constituted within a week.

The RBI Board on Monday had decided on an expert committee to look into the ECF.

The composition of the committee and its terms of reference will be jointly decided by Union finance minister Arun Jaitley and RBI governor Urjit Patel. The committee will also have outside members and experts, sources said.

The government feels that the surplus can be transferred to it as the accumulated reserves are far too high and not in line with global practices. Currently, the central bank has reserves of Rs 9.69 lakh crore.

The committee will look into the norms to decide on the RBI’s surplus amount and a formula for transferring the money to the banks and the appropriate level of reserves the central bank should hold.