Taxation

Know Your Taxes: GST

GST stands for Goods and Service Tax and it came into effect on July 1st, 2017. It is one indirect tax for the entire country and replaced a number of indirect taxes that previously existed.

GST is a comprehensive, multi-stage destination-based tax that is levied at every point of sale on the supply of goods and services. In this write-up, we will take a look at the types of GST, its advantages and its impact.

TYPES

There are 3 kinds of taxes under GST- CGST, SGST and IGST.

CGST:

It is collected by the Central Government on the sale happening within a state.

SGST:

Collected by the State Government on the sale happening within a state.

IGST:

This one is collected by the Central Government on inter-state sale that is one state to another.

So simply put, if it is an intra-state sale, you have to pay CGST and SGST both while for inter-state, it’s just IGST.

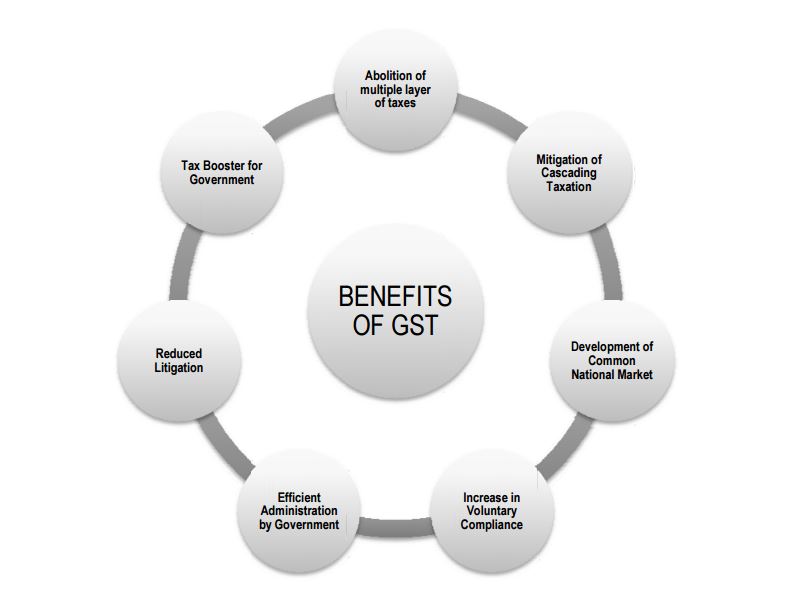

ADVANTAGES

Now there must be a reason why the Government decided to replace all the earlier indirect taxes with GST right? They are –

• Removal of Cascading effect

The Cascading tax effect means that the consumer has to bear the load of tax on tax. A kind of snowball effect which results in inflationary prices. But since the introduction of GST, this burden has lightened up considerable given we now only have to give one tax for all.

• Easy handling

Earlier, handling all the numerous indirect taxes was kind of complicated for the administration but GST replaced them all with a single tax- which is much easier to handle and a more organized system.

• Easier for businesses

GST also increased the ease of doing business as now the companies don’t have to worry about dozens of indirect taxes.

• Preventing tax leakage and corruption

Since the entire process of GST is handled through online portal network, the taxpayer can directly register; pay and file return which lessens the possibility of corrupt practices of the authorities by a lot.

IMPACT OF GST

By removing the dozens of indirect taxes, not only the taxpayers could take some relief but the entire tax structure became more organized too. Also being technologically driven speeded up the process, thus less hassle and improved collection. The tax rate became uniform too.