Business

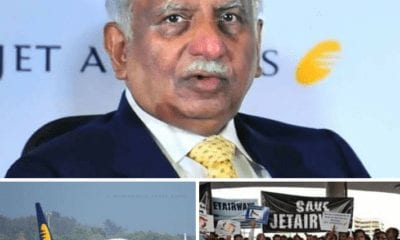

Lenders ask Jet Airways’s Naresh Goyal to prune stake below 10%

It could be the end of the road for Naresh Goyal, the chairman and founder of the struggling Jet Airways. Lenders, led by the State Bank of India (SBI), have asked Goyal to bring down his stake in the cash-strapped company to below 10% as well as exit the Board in a last-ditch effort to rescue the airline from being grounded.

However, the task at hand for the lenders is also getting more difficult as minority partner Etihad Airways has also expressed its desire to exit the venture. While the Abu Dhabi-based investor holds a 24% stake, Goyal owns 51% in Jet Airways.

Lenders have also sought the rejig of the company’s existing Board, which would involve the stepping down of Goyal, his wife Anita and his associates. After the Board rejig, banks are planning to infuse fresh capital between Rs 800-1,000 crore to keep the airline afloat.

“We have told Goyal and his wife and other board members to step down so that a professionally run board can be in place to run Jet Airways. All interested investors want Goyal to give up management control. In the interim period, until a new investor comes in, banks will hold a majority stake in the airline,” said a banker who is part of the consortium members.

Banks are yet to take a call on whether it wants to acquire Etihad’s stake in Jet Airways. Etihad has told lenders that it will not infuse additional funds into the ailing airline and, in fact, wants to sell its stake, the source added.

The restructuring plan will see the induction of two bankers on the Board. Jet Airways Board has nine members, including Goyal, his wife Anita (non-executive member), Rajshree Pathy (chairman of Rajshree Sugars and Chemicals Ltd) and Gaurang Shetty (whole time director). Etihad is represented by two board members – Robin Kamar and Kevin Knight. The other independent directors on the board include Dr Nasim Zaidi (Chief Election Commissioner of India from 2015 till 2017), retired bureaucrat Ashok Chawla and Sharad Sharma (former SBI official).

“A few investors are interested. Domestic airlines may also be keen to pick up stake in Jet Airways,” said another banker who refused to reveal the names of likely investors.

Meanwhile, 260 pilots of Jet Airways have appeared for an interview conducted by SpiceJet in Mumbai on Wednesday. The low-cost carrier is looking to expand. Jet Airways’ pilots have threatened that they will not fly from April 1 if the management fails to provide clarity on the revival plan along with the deadline to clear their salary dues by March 31. Meanwhile the government reportedly has asked SpiceJet to fly the grounded Jet Airways aircrafts .

While the lenders are working hard on a resolution plan, they are not being able to broker a deal between Goyal and Etihad. Some agreement has to be reached to prevent Jet Airways from going into the National Company Law Tribunal (NCLT).

Earlier, SBI chairman Rajnish Kumar told reporters in Delhi that “it is in everybody’s interest that Jet Airways continues to fly and we will make every effort to see that the airline is rescued. No lender wants to take Jet Airways to the bankruptcy courts. In a service industry where businesses operate with few physical assets of their own and rely a lot on brand name and customer confidence, bankruptcy proceedings could hurt the airline’s ability to remain in business.”

Kumar was in Delhi on Wednesday where he met finance minister Arun Jaitley along with aviation secretary Pradip Singh Kharola and Nripendra Misra, principal secretary to Prime Minister Narendra Modi.