Telecom

Telecom companies, consumers have a reason to worry

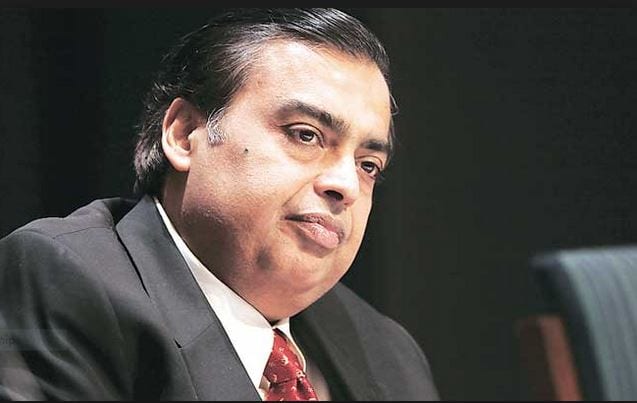

Since the entry of Reliance Jio in 2016, the sector has grown dramatically. For example, the sharp fall in the price of internet access, a boost in data consumption and speeds are all welcome news. However, the unprecedented levels of debt in the telecom sector, the much-reduced competition, the falling revenues of the older operators, and their decision to drop low spending subscribers, are very bad news indeed. Should we worry?

A few numbers will concentrate our minds. The combined debt of the sector is over 7 lakh crore. This is roughly evenly divided between incumbent players (Vodafone, Idea and Airtel) and those that have stopped operating or exited (e.g. Tata, Aircel, Reliance Communications). The sector has also lost major international players like Norway’s Nortel and Russia’s MTS. Since Jio entered the game, revenues of existing players went down around 29%. Their average revenue per user (ARPU) has also dipped by 42%. These players may have already dropped from their networks an estimated 10 million customers who do not generate enough revenues to justify keeping them on the network.

This raises key questions about the commercial viability of the incumbent players even as Reliance Jio claims there is no financial crisis. Some would argue that commercially driven private players must accept punishments meted out by markets in the same way as they enjoy their rewards. The governments and regulators must resist intervening in markets and distorting them further.

However, this is untenable. Except for roughly 10% who subscribe to government-owned BSNL/MTNL, Indians rely almost exclusively on private players for key infrastructure like telecom and internet. An unviable sector or the exit of more private players has a bearing on public interest. It poses risks of insufficient competition and of course, defaults on loans especially since many involve publicly owned banks.

The government cannot ignore these risks. Nor can the Telecom Regulatory Authority of India (Trai) which has statutory responsibility for orderly growth of the sector. Of course, neither can justify reverting to the bad old days of price control, given the immense success of markets in improving affordability and access. They will need to find other ‘non-distorting’ ways to relieve the financial burden on the players. However, their task is not easy unless they review some of their recent approaches.

A key barrier is a current practice of setting government levies – like licence fees and spectrum usage charges- as a percentage of operators’ revenues. This means all financial relief to players, in the form of lower levies, comes with a corresponding dent on government revenues. Most bureaucrats, with a responsibility to protect government revenues, have been and are understandably reluctant to cut levies to any significant extent. More so, since such decisions have been increasingly contentious.

The National Digital Communications Policy (NDCP) of 2018 could have helped resolve this predicament. The policy could, for instance, have clarified that the government recognises the risk to the economy at large of a financially stretched telecom sector. It could have removed the current link between government levies and revenues of the players. It could instead have bet on the high revenues the reform would generate, not just for the telecom sector but also the economy at large. And, it would end the hundreds of cases between players and the government over the computation of revenues.

However, such a shift in approach would be possible only if was part of a policy approved by the cabinet, as is the norm. Unfortunately, that opportunity was missed. Time will tell when we can correct this problem. Till then, both the telecommunications sector and its consumers have reasons to worry.